There are several explanations for why you may have a strong credit score or a poor one. Yet you may wind up having stable revenue and a lower cap on your credit card if you’re joining the job force. The X1 Card intends to fix this by imposing limits on your present and potential earnings rather than your credit score.

Many clients can foresee limits five times higher than they’d ever received from a standard credit card, the company notes. And if you receive a job raise, for example, the limit will go up.

“The retail credit card market has remained almost unaffected by innovations and focused on an obsolete and outdated credit scoring system.” “We’ve re-shaped the credit card first from the roots up with smarter limitations, innovative amenities, unique incentives, and a new approach.” — Deepak Rao (Co-Founder).

You will get a changeable APR from 12.9 up to 19.9 % and a balance transaction charge of 2% based on the credit ratings. There is no yearly membership/subscription cost, and X1 Card does not alter any late fees or international transaction fees. Besides, you can also borrow 25% of your overall internship income, and in the case of a full-time job, you can borrow 25% from your first three salaries.

The X1 Card; What We Know

Founded by Thrive, The X1 Card is a Visa steel (stainless) Card that deals with Apple and Google Play. Talking about Thrive, it’s a company that has built Thrive Cash, a lending service that helps you get a credit line focused on providing letters for your next internship or your first full-time post-college job.

The X1 Card lets you manage your subscriptions in a variety of different ways. First of all, you can terminate your subscription purchases through the app. If you are using a new system and they ask you to input your credit card details to begin a trial period, you also can produce a digital credit card that expires automatically.

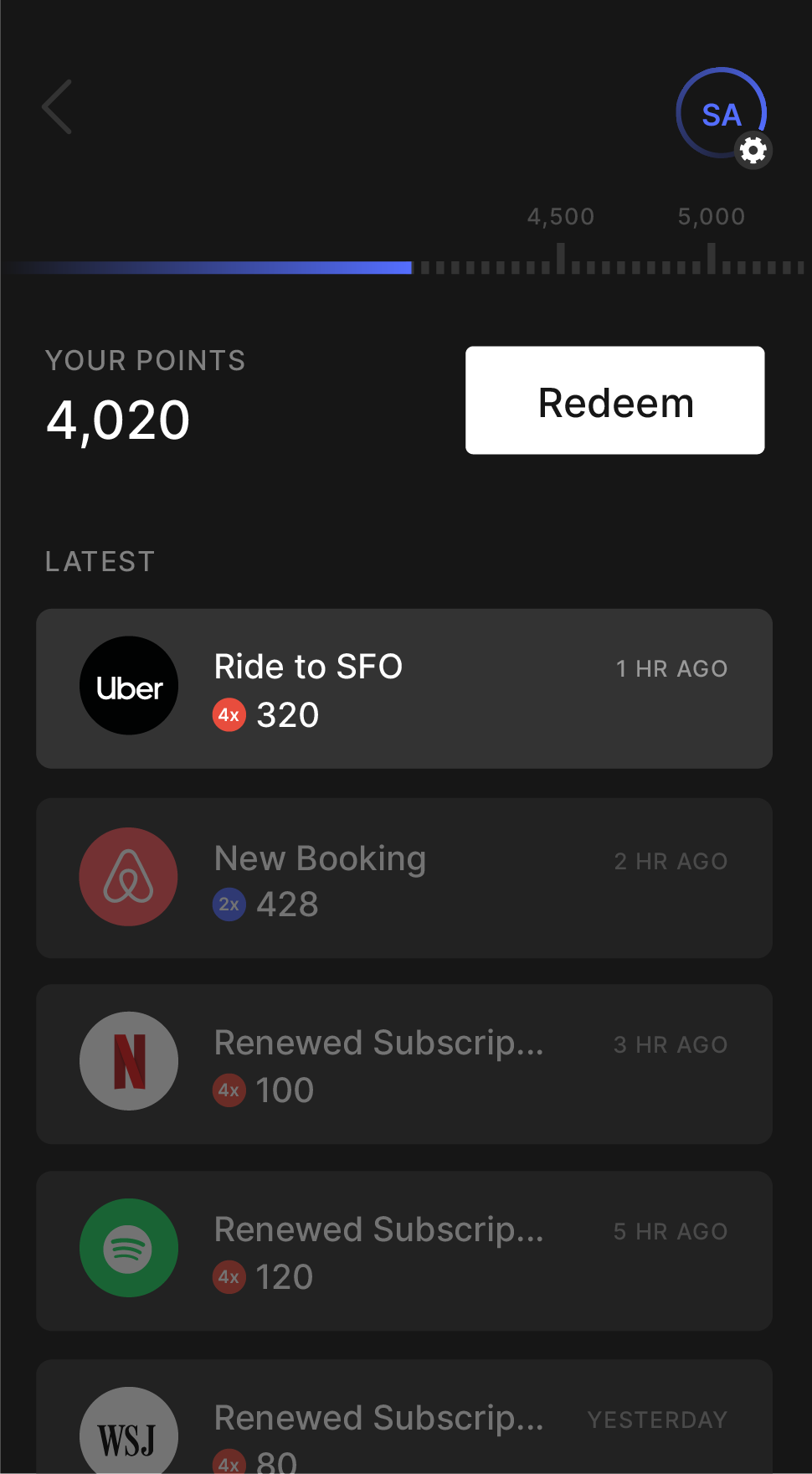

Not only that, the X1 Card notifies you if you get a refund. You may also add receipts to your transactions in the app. X1 Card incorporates points when it applies to rewards.

- You receive 2x points for all transactions; there are no categories or distributors that offer you such unique and exclusive incentives.

- If you pay $15,000 or more than $15,000 with your Card in a whole year, you earn 3X points.

- If you recommend a pal, you can earn 4X points on your transactions for a month — every new referral offers an entire month of 4X points.

- You can redeem your points from retail partners, including Airbnb, Delta, Everlane, Apple, etc.

Bottom Line

That is a credit card, in other terms. But the fascinating thing about this Card is that it aims to undermine the credit scoring system. It’ll be really exciting to see how people will achieve higher limits with this system.

Image credits: X1 Card